Product Case Study

Narrowing Infor’s Mobile Footprint

Infor is an enterprise software company in the process of modernizing their ERP business and transitioning to a SaaS model. In the mobile space, lack of a unifying strategy had led to a fragmented product footprint — there were over 50 customer-facing apps. Within this portfolio overly narrow and sometimes overlapping functionality had resulted in customer confusion and duplicative development costs. Inconsistent user experiences across the apps detracted from user onboarding and training; and our customers’ IT organizations found it difficult to efficiently couple the right app to their Infor ERP platforms.

These issues diminished the effectiveness of cross-selling Infor’s portfolio. Infor needed to consolidate its mobile business applications to better serve our users and help optimize platform development efforts. In this case study I describe how I defined a new product strategy for Infor and how my team kicked-off agile development of net-new mobile applications.

Consolidation Analysis

My efforts towards a new strategy began by studying Infor’s current mobile footprint. Clearly, we had far too many mobile apps, but there was no consensus across the business about how we might streamline our offering. Each division had its favorites and few could see the big messy picture.

“[I]n order for checklists to be updated on the desktop, the user must complete a checklist and save [on mobile], then go to another work order and come back to the work order that was being worked to completion, then the data will sync correctly with the desktop. This is counterintuitve and unnecessary.”

I started with product feedback from our customer support channels: A trove of support cases, enhancement requests, and app store reviews documented issues with the user experiences and functionality of our mobile products. Some out-of-date apps had been built to suit now-defunct ERP workflows or had not been updated to work on current devices. In other instances, app development had disregarded mobile interaction patterns or best practices storing and retrieving data to begin with. For example, poorly implemented client-side caching forced a roundabout workflow:

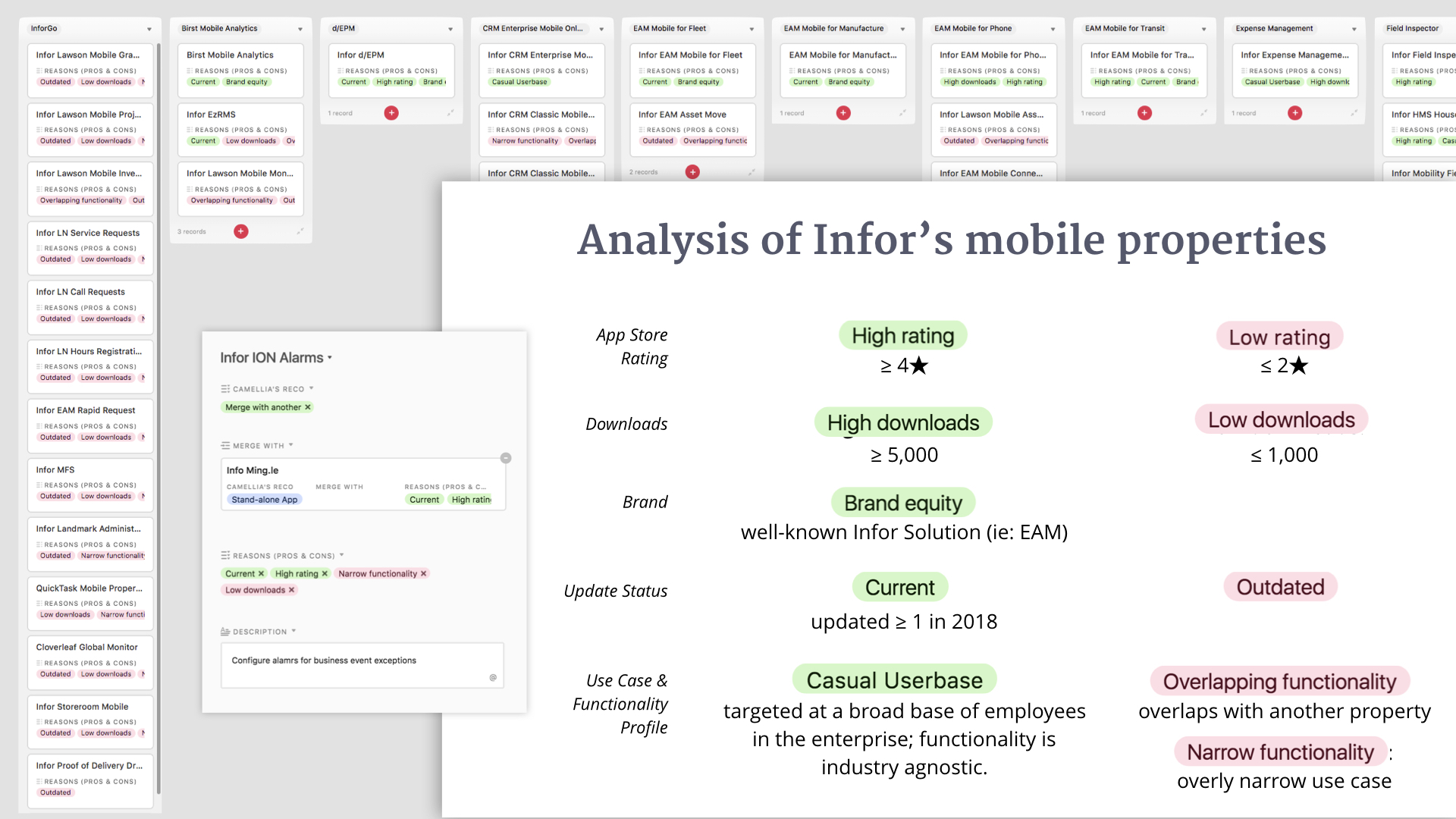

Next, I assessed market viability of each mobile property. I combined customer feedback and internal understanding of each app’s use cases and code base with marketing data from Android and iOS app stores. My approach resulted in a holistic profile of Infor’s existing mobile apps. The profile graded each product along the following dimensions:

App store ratings & downloads: these effect how apps appear in search results and contribute to Infor’s overall regard in the mobile space. (Given the specialized nature of Infor’s business applications, download numbers are very low relative to consumer products.)

Brand equity: is the associated ERP platform well-known and well-regarded? does having a native companion app strengthen this Infor brand?

Update status: is the code base current? is their a dev team actively improving app functionality?

Breadth and uniqueness of use case: does the apps’ use case and functionality support enough customers to be viable? would merger with another property make a more compelling or more marketable product?

Using this analysis, I grouped 50+ apps by functionality. These categories were intended to facilitate dev efficiency and code reuse across shared data types and workflows. Within each group I defined which apps should be invested in which should absorb the users and data types of less valuable products. My goal was to consolidate multiple products into a single, viable offering.

Customer-Driven Companion Strategy

My plan recommended going forward with about 15 apps. This was a small enough footprint for Infor to build and maintain effectively, but still far too varied to communicate a cohesive strategy without getting into the weeds. I mapped the go-forward products to four key customer personas that could shape market communications, user experience principles and technical product requirements.

BI Dashboards & Reporting Apps

targeted at executive decision makersThese are the tools of decision makers on customer side.

Mobile helps them feel in control of their business.

Field Service

targeted at field sales & service repsThese are the tools of field sales & field service workers.

Mobile is where they get work done.

Employee Apps

for employee : employer interactionsThese are the tools of everyday employees..

Mobile might be their only access to their intranet.

Infor Go & Ming.le

for enterprise coordination and collaborationThese are tools for to enable an enormous number of narrow use cases and collaboration tools.

Mobile is a brand and platform play.

This approach aligned well with Infor’s established strategy to architect its web portfolio around “role-based applications.” Each go-forward product would be refined or redesigned to facilitate the work of one of these primary user types. For example, sophisticated data visualization patterns benefit executives across manufacturing, healthcare or government. While robust offline capabilities are valuable to anyone who works in the field regardless of their industry. In most cases, the mobile experience would serve as a companion to the ERP functionality on the web. Employee apps were the exception to this companion strategy. These apps target a group of users who might not have work computers at all, instead accessing employer tools with their personal mobile devices.

Agile Lifecycle

Establishing Goals

In parallel with defining a go-forward product strategy, I worked with executive leadership and Infor’s industry solutions teams to set product goals for the consolidated mobile portfolio. As every mobile app would require coordination across platform and app development teams, implementation teams, sales and marketing, it was critical to concisely capture development and marketing plans across all aspects of the business.

Trigger open API development to modernize all experiences with Infor’s legacy platforms

Launch 4 net-new native mobile apps in FY19: 1 field service, 2 employee apps, 1 workflow aggregator (Infor Go)

Bootstrap mobile UI Kit, reusable patterns, & usage analytics libraries for core development teams; enable self-service provisioning

Win new deals, upgrade existing customers

Incentivize multi-tenant SaaS contracts

Fortify Infor’s mobile properties in iOS & Android app stores

Prototyping the Operating Model

I managed the product squads responsible for developing the first versions of new field service and employees apps. With product goals in mind I began to define how we would kickstart an efficient dev lifecycle and user centered design process. We planned to roll-out our operating model in three phases:

Phase 1

Establish our process with a single mobile product

Define squad roles, dev lifecycle & platform-team touchpoints

Articulate best practices for APIs, mobile architecture

Roadmap functionality with customer co-development engagement

Phase 2

Scale development up to three apps

First iteration of product ops & user experience standards in reusable code libraries

Go-to-market with an additional mode of customer engagement (eg: customer advisory board)

Phase 3

Strategically deliver on the long-tail

Address narrow use-cases via workflow aggregator app

Our First Product: Expense Management

Working in our new model, one of my product squads collaborated with Infor’s XM platform team and a “lead-adopter” customer to design and build a new mobile app. The product enables easy expense tracking and reimbursement for traveling consultants.